– Hulu’s The Handmaid’s Tale is their biggest show, but that’s only good for the 18th best streaming season among all streamers.

– After a great year of action films in 2020, 2021 has seen a few Netflix action films underperform their predecessors.

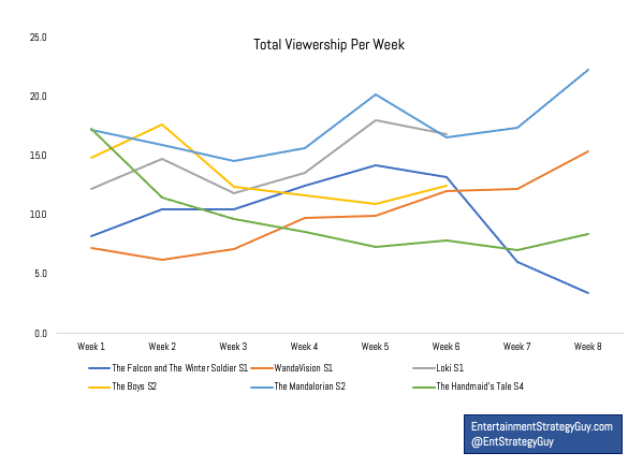

– Loki is the biggest series by “viewership per episode” and maybe Disney’s biggest hit this year.

– Black Widow dropped 18% in its second week of PVOD sales. It’s unclear if this is bad or merely fine.

Figuring out who is “winning” in the streaming wars can be tough. Especially when it comes to subscriber counts. Some companies provide global counts, some provide selective data, and some don’t provide any data at all. To help out, I released “US Streaming Subscriber estimates for Q2 of 2021” over at my website. I created officially unofficial estimates for every major streamer:

Read my website for details. Now onto the streaming ratings report.

(Reminder: The streaming ratings report compiles data from Nielsen’s weekly top ten viewership ranks, Netflix datecdotes, Top Ten lists, Google Trends and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of July 12th to July 18th.)

Television

I’ve been waiting for weeks for Hulu’s The Handmaid’s Tale to finally drop off Nielsen’s Top Ten lists. Not that I have anything against it as a show, but I had pencilled it in for a deep dive, and it lasted for 3 weeks past its season finale. That’s a lot. Combine this with Loki’s strong season finale ratings, and The Walt Disney Company had a good week in the ratings. But just how good?

First, Hulu says The Handmaid’s Tale is their biggest show yet. As I’ve noted before, Hulu has made an art form out of obscure datecdotes. Unlike Netflix, who at least provides numbers, Hulu only provides comparisons to other titles on their service. For The Handmaid’s Tale, they provided four total datecdotes in two installments:

– After the premiere, Hulu told Deadline that season four “ranks as the streamer’s most watched original –for either a film or TV series season debut– during the course of a week.”

– After the season finale, Hulu execs told the Television Critics Association that The Handmaid’s Tale season four was the most watched series on Hulu every week since it premiered, the finale was the most watched episode on premiere day ever and that season 3 to season four viewership grew 32%.

Now we can update our “Hulu datecdotes chart”:

So what do we make of it? Well, The Handmaid’s Tale is clearly Hulu’s biggest hit. Season four finished with 88 million total hours over the last three months or so. Even better, with the 32% growth number, we can estimate that total viewing of season three in 2019 was around 67 million total hours.

But how good is that? Really?

I’d say it isn’t. (I’m going on a pinch of a negativity bender this week.)

Again, this is Hulu’s biggest hit in the US, by far, going into its fourth season. But looking at the top season releases by total viewership, that’s good for the 18th best launch in the data set. For as many episodes and seasons as The Handmaid’s Tale has, you’d expect it to compete with The Crown or Cobra Kai, and it clearly lags those titles.

(One caveat may be Ozark, which benefitted from the lockdown, so it may be a permanent outlier.)

Does this mean that Disney’s Star Wars and Marvel series are failures as well? Not really. Look, Hulu has been around as long as Netflix, and has one Hulu Original that can make the top 20 or so series releases. Disney has been around for coming up on two years, and it already has four titles in the top 18. Not to mention, Disney+ series keep folks to the service each week because of the weekly releases. For example, here are the top series ranked by “viewership per episode” per week through the first 8 weeks:

Two Disney series bumped off two Netflix series since I last updated this after WandaVision’s premiere. (Ratched and The Umbrella Academy fell off.) Yes, that view benefits the first season of a series (due to fewer episodes), but for the most part Disney+ series grew over their weekly release schedule. See…

If I’m looking at Disney’s two major streamers, I see one that can reliably churn hits that keep folks tethered to the service for weeks at a time and I see one service that has a good weekly hit, but not a great one. Sure Hulu can defend themselves by saying, “Hey look at your subscriber tables. We’re half the size of Netflix but can still launch big hits.” But the goal isn’t to be half the size of Netflix it’s for Hulu to catch up to Netflix.

They have a lot of work to do on the originals front to make that happen.

Quick Notes on TV

– TV Premiere: Never Have I Ever Season 2. With 15 months of Nielsen data, we can now compare season launches to each other. The latest is Never Have I Ever, a Mindy Kaling created Netflix original. In this case, season 1 launched in April of 2020 to 13 million million hours of viewership. Season 2 debuted this week to 8 million hours, a decline of 63%. But be careful. Season 1 released on a Monday and season 2 released on a Thursday. When you look at “viewership per day”, it’s slightly up (to 2.0 million hours per day from 1.9 million). That’s good for 12th place out of 19 season two examples.)

– TV Premiere: The Cook of Castamar Season 1. What do you do if a sex-filled period drama takes over your service in December? Find a quick follow up. At 4.9 million hours in its second week, Castamar will probably drop off the list next week. That’s good for 60th out of 68 season 1 launches in my data set. (Foreign language originals—this is from Spain—continue to underperform in the US.)

– TV Premiere: Heist. Heist, a six episode true crime series from Netflix, also failed to launch, with only 6.2 million hours in its second week. That’s good for 57th out of 68 season 1 launches in my data set.

– Virgin River passed Manifest for the number one spot on the total streaming charts this week. We’ll check in with it when it finishes its run on the Netflix charts, but Netflix seems to have a good hit to follow up Manifest. (And yes it helps that both have around 30 episodes released.)

– Speaking of Manifest, it’s decay curve finally started to match other big Netflix series:

Film

My brother and I play a game every so often with Netflix titles. It’s called, “What’s this about?” Take Black Summer. Is Black Summer a darkly-comedic coming of age tale? A prestige drama based on true events in the deep south during the Jim Crow era? A raunchy comedy?

It turns out it’s a zombie series. Huh.

Gunpowder Milkshake fits the bill too. Before I started reaching this column I would have given anything that it was the latest anime title to hit Netflix. But it turns out…

It’s a hard R action film! Starring Karen Gillan and some other stars. And it cost $30 million dollars to make. Now it’s time to turn my shade towards Netflix: do they have a “hard R” action problem?

A year ago “hard R” was the engine that drove Netflix. Of their top ten “datecdotes”, 5 series are “hard R” action films. To overwhelm you with data, here’s a table with tons of data points to parse:

Let’s make that simpler. Here are Nielsen week one ratings for the last six Hard R films:

To over simplify, starting with 6 Underground, Netflix went on a mini-streak, launching on successful hard R action film per quarter. (6 Underground, Spenser Confidential, Army of the Dead, The Old Guard). Since then, it’s been a bit downhill. Outside the Wire failed to launch and Gunpowder Milkshake didn’t hit either. Even Army of the Dead is down compared to the high heights of Extraction, only getting 75 million households to tune in to Extraction’s 99 million.

Pulling this data, I was also a bit surprised to see how low the IMDb ratings are for these films across the board. 6.7 is the highest rating, shared by The Old Guard and Bird Box. (In IMDb terms, 7 to 8 is “good”, whereas 8+ is “great”.) And you can see that the two lowest rated titles are also the least viewed so far.

Whenever I mention IMDb, folks love to complain that it is biased. Towards certain genres, I agree. But within a genre like action? I don’t think so. See…

It’s not the world’s strongest correlation, but it’s there. Lastly, you can see this in the Google Trends data:

Add it all up and I don’t expect Gunpowder Milkshake will get the “datecdote” treatment unless it really picks up. Even if it does, I doubt it passes Outside the Wire.

Lastly, there’s potential good news lurking. Red Notice is the next big blockbuster for Netflix and given the cast it will likely perform. We’ll see.

Quick Notes on Film

– Black Widow dropped 18% into its second week of full PVOD. Normally, I’d expect a film to drop from its opening weekend to its second, especially in home entertainment and box office. But past PVOD films have actually grown slightly with a full week of data. Further, both Cruella and Raya and the Last Dragon both grew in viewership into their second weekend. While you can argue that Raya and the Last Dragon is a kids film benefiting from rewatches (absolutely true!), Cruella is much less of a kids film. Counter to this, Mulan likely dropped at least 18%, since the maximum viewership it got in week two was 7.2 million hours.

Look, we only have four PVOD data points and one of those is limited. (We don’t have Mulan’s second weekend.) But you can see that other series at least grew slightly. And this is more data that Black Widow’s decay in theaters may have less to do with its release style than potential weakness in the film.

– The Fear Street saga concluded with Part Three. It had a better “per day” debut than the past premieres, but we’ll see how it holds. This was a fascinating experiment for Netflix, but didn’t drive as much interest as Twilight, which made the list this week after premiering on

– Moana made it back to the top ten after a one week absence. As Luca continues to drop week-over-week, it will be fun to see how the “Disney staples” fare. Does Frozen return? Does Raya or Luca drop off? This should tell us plenty about the staying power of Disney films over time.

Anecdata of the Week

Given that I have Hulu on the brain, I wanted to highlight a look at the overall catalogues from the streaming services by Parrot Analytics. I don’t use Parrot’s data week-to-week because I have some questions about their methodology. They use lots of social data, and frankly I don’t like social data to predict behavior. (It’s the most biased of biased samples out there.)

But on a high level it can pull some interesting conclusions, especially at a catalogue level. When you look at all of Hulu’s catalogue, you can see how powerful licensed, current (meaning on air right now) broadcast and cable series are:

(Source: Parrot Analytics)

Indeed, at a high level, they compete with Netflix:

Coming Soon!

– Lord of the Rings TV prequel. Sorry, not soon. On September 2nd of 2022. This is a bold move by Amazon to try to seize the release date a year ahead of time, and strikes me a bit like the musical chairs of film studios to claim weekends. Frankly, this is also great news for data heads, since we’ll have oodles of data to know if the most expensive series in TV history was worth it. The ultimate “TBD”.

– Black Widow on home entertainment. I don’t usually cite home entertainment releases here, but Black Widow—which I just talked about—is one of the more fascinating data points out there. After only four weeks, Disney+’s exclusivity is over and Black Widow is available on Amazon, iTunes, Google and other video-on-demand stores. And, not surprisingly, it’s on the top of the charts.