If I didn’t have a little Padawan join my family in November, one of my goals was to update my massive “How Much Money did Disney Make on the Lucasfilm Acquisition?” series. That delay actually helped because I wouldn’t have been able to get that article up before Rise of the Skywalker came out. Meaning I would have had to guess on a billion dollar variable!

And since I didn’t have to guess, we know that Rise of Skywalker joined the caravan of Disney billion dollar box office film in 2010s. Still following Lucasfilm/Star Wars in 2019 had a sense of dread. For every good news story there was a bad one. So how do we truly judge—from a business sense—how well Lucasfilm did in 2019?

We use numbers. Strategy is numbers, right?

Since Disney doesn’t release franchise financials—why would they?—I have my own estimates. I last updated these in the beginning of 2019 (with films updated in 2018) so I’ll do a big update to the model to learn what we can about how well Lucasfilm did in 2019. I’ll break it into two parts. Today’s article will cover movies; next week, I’ll review the rest of the business units, TV, licensing and theme parks. Previously, I only focused on the price Disney paid compared to their performance. Today and next week’s article will instead act as a report card on how 2019 impacted Lucasfilm and Disney’s business/future.

What this Analysis is NOT

There are so many cultural takes on Star Wars, especially since The Last Jedi, that I feel it’s important to clarify what I’m NOT doing here. (A UCLA forum I follow, for example, had a 60 page “debate” on the latest two films.)

To start, this isn’t my “fan” opinion on the franchise. My opinion is just one person’s opinion, so whether or not I “loved” the latest film, or the one before it or “the baby of the same species as Yoda” doesn’t matter. In the aggregate, Disney does and they track this via surveys and focus groups. But lone individuals online? Whether they love or hate recent moves? Not so much.

To follow that, this isn’t a “critical” perspective either. I haven’t been trained in the dark arts of cultural and film criticism, so my opinion again just doesn’t matter. (Does Disney care about the critics? Controversially, I’d argue not really.)

What this Analysis IS

Instead, I’ll focus on three areas per business unit for Star Wars (read Lucasfilm):

Profit from 2019 (most accurately, operating profit)

In my big series on the Lucasfilm acquisition, I was looking at a specific question about the value of Star Wars vis a vis the price Disney paid. But if you’re Disney, that deal is now a sunk cost. What matters for Disney strategists or brand managers is how much money the franchise is making now. That’s the focus.

Long term impacts on the financial model and the 2014 deal

Since I have a gigantic spreadsheet filled numbers that I can update putting this all in terms of the $4 billion (in 2014 dollars) context, I may as well update how the model has changed. Further, some decisions Disney makes now will directly impact how much potential profit they can keep making on Star Wars. So I’ll update that too.

Brand Value

This last part is the hardest part to quantify, but is crucial as well for putting the above two decisions into context. See, a brand manager doesn’t just care about making money this year, they care about making money next year and the year after and so on. And there are ways to make money in the short term that damage a brand in the long. Threading the needle of making money while building brand equity, not just drawing it down, is crucial for a brand manager.

This is admittedly a tough section to quantify, but it still feels particularly important. (Again, the goal is not to sneak in my opinion, but use data where possible to figure this out. Though narratives will likely figure in.)

With those caveats, let’s hop into the most important business unit, the straw that stirs the blue milk, films.

Movies

As of publishing, Rise of the Skywalker grossed $1.05 billion, with a 48% US/Canada to 52% international split. In my model—which I’ll repeat is a lifetime model, meaning all future revenue streams—I’d expect Rise of the Skywalker to net Lucasfilm $798 million, nearly identical to Rogue One. (As I clarified before, my model is a bit high compared to Deadlines’ model. There are a few reasons, but mainly I calculate lifetime value.) So that’s the first building block for how Star Wars did in 2019. In my framework of films, I’d have called this a “hit”. Here’s a table with Disney’s 5 Star Wars films in the 2010s:

But what does this mean?

But what does this mean?

Star Wars Feature Film Trend Lines

That’s where things get tricky. The key question for me is context. If we were using “value over replacement” theory, and you looked at the last Star Wars in “value over replacement film”, well it does terrific. Very few films get over a billion dollars at the box office!

However, I’d argue that’s the wrong context. This is a Star Wars film. So how did Episode IX do in “value over replacement Star Wars films” context? Not very good. To show this, I updated my giant “franchise” tracker through 2019.

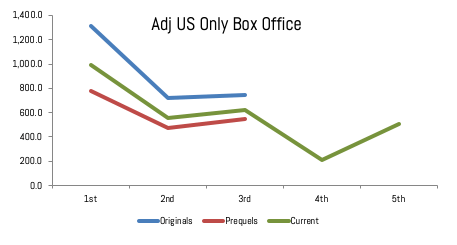

Let’s start by just charting Star Wars film performance. First by category, separating “A Star Wars Story” into their own category. Second, by release order by decade.

The worrying issue for Star Wars brand strategists are the trend lines. This isn’t a series trending upwards or even maintaining consistent film launches. If Disney wanted to reassure themselves, they could say it isn’t their fault, lots of franchises lose their mojo over time, like Lord of The Rings, Transformers or Pirates of the Caribbean. Here is the chart I made in 2018 for franchise performance, updated through 2019 launches. They show the US adjusted box office and how series have trended over time:

In this first view, you can see that Star Wars has long been in a class all it’s own. But it’s trending downward compared to other franchises. For a really impressive look, though, here’s what the MCU has done just this decade:

Comparing the two, Star Wars is clearly a franchise losing steam whereas the MCU is taking over everything. As the MCU wrapped up its major series, it actually peaked in box office, whereas Star Wars did not. I’d add Harry Potter managed to peak in its last film in the first series too.

Finally, here’s a look at franchises over time. This might be my favorite chart I’ve ever created. It shows how crowded the franchise market is getting:

This performance directly implies the question, “So how does this impact brand value?” Going strictly off the behavioral inputs—meaning what do people do versus say they will do—in the US, Star Wars, is softening at the theaters. It is no longer a guaranteed billion dollar movie machine. (And consider what it means that Disney launched four “billion dollar box office” films in the same franchise in the last decade.) Globally, it’s definitely weakening, especially in ever valuable China.

This performance directly implies the question, “So how does this impact brand value?” Going strictly off the behavioral inputs—meaning what do people do versus say they will do—in the US, Star Wars, is softening at the theaters. It is no longer a guaranteed billion dollar movie machine. (And consider what it means that Disney launched four “billion dollar box office” films in the same franchise in the last decade.) Globally, it’s definitely weakening, especially in ever valuable China.

The question tearing the internet apart, though, is what caused this: The Last Jedi or Rise of Skywalker? I could make the narrative arguments either way. But instead, data!

Uh, that doesn’t really help. (I selectively colored the films this decade looking for trends.) If you want, you can cherry pick data points on either side. Rise of Skywalker had the lowest Cinemascore of any Star Wars film, including the prequels. The Last Jedi, meanwhile, did poorly on Rotten Tomatoes and Metacritic. They’re about the same on IMDb. (Yes, I know that some trolls may have downvoted The Last Jedi before seeing it. That’s why I pulled multiple numbers. Also, the vote totals actually aren’t that much higher than Force Awakens so it’s still probably directionally accurate.)

I’d step back and say it’s not about any particular film but about the lack of a cohesive whole in the last trilogy. The analogy I’d use is the “story game” I play with my daughter. Each person tells one part of a story and we see where it goes. But when you play with a four year old, well she can drop wild plot twists. I wouldn’t publish any of our stories.

From reporting, it sounds like that’s how well JJ Abrams and Rian Johnson worked together. Abrams started a series that Johnson pivoted immediately off, and Abrams desperately tried to pivot back. It didn’t work. I’m reminded of the old saw, “The only bad decision is no decision.” Maybe there is: flip flopping back and forth!

As a result, the brand equity is trending in the wrong direction, even as they made billions on the last film. Clearly if more films were coming from Star Wars this year, we’d expect more Solo-esque performances than Rogue One. And that’s what worries Disney strategists.

(As for who to blame? I’d just blame all the principals equally, from Bob Iger to Kathleen Kennedy to Alan Horn to Abrams/Johnson. In this case, failure deserves multiple parents.)

Updating The Star Wars Feature Film Model Going Forward

Let’s translate this into dollars and cents credits.

How does this impact the model? Well, it means that I’m going to have more scenarios where Star Wars’ box office resembles other franchises instead of mimicking Star Wars history. Instead of producing routine billion dollar lifetime profits—my projection for The Last Jedi—I’ll have more $50 million dollar losses. (My projection for Solo, which ended up being almost exactly what Disney leaked was the loss!) As a reminder, here are my percentages by category:

The big change since 2018 is that Star Wars hadn’t had a flop yet. As for the rate of blockbuster hits, they’re basically unchanged with 18 more months of data. (That surprised me.)

After the performance, the other big driver of film profit is how often the studio produces films. Crucially, though, making huge hits is more valuable than more frequent “median” blockbuster films. After the Solo flop, I wrote that it made sense to dial back the pace of Star Wars films to keep the average high.

Well guess who listened? (Probably not, but they likely have similar models and drew the same conclusions from the data.) Bob Iger announced that Star Wars films were taking a three year hiatus after 2019. Then, Benioff & Weiss dropped out of making their trilogy, meaning the future of Star Wars is three films between 2022 and 2026. They have also put Indiana Jones 5 tentatively on the calendar for 2021.

Thus I made two output scenarios for my model. In “Issues”, Indiana Jones 5 doesn’t happen and Disney only makes 3 more films in the 2020s. In success, though, I made a “Ramp Up” scenario, where Disney keeps IJ5 on the calendar and adds two more films:

Why don’t I have Indiana Jones 5 in one of the scenarios? Because frankly I think it has a high probability of not happening. Further, I’ve removed guessing what future Star Wars films could be, because clearly all the leaks about Obi-Wan or Boba Fett movies were leaks about Disney+ TV shows. So I just put in two TBD placeholders.

As for how well the films do, I’m going to do a range of outcomes again from “franchise fatigue” to “Star Wars is Star Wars”, meaning Rian Johnson restores balance to the Star Wars universe. This means I’ll have four scenarios (instead of the nine I had last time).

Thus, we come to the end. We can add in The Rise of Skywalker performance, update the calendar, apple the blockbuster average performance, and as a result get our scenarios. Here are the two models I built, each with two scenarios. (That’s not moon, that’s a financial model.)

The “Issues” scenario…

The “ramp back” scenario…

The “ramp back” scenario…

That’s a lot to take in. Here are the key numbers summarized. Essentially, the net profit by year and how that compares to the initial price of Lucasfilm:

That’s a lot to take in. Here are the key numbers summarized. Essentially, the net profit by year and how that compares to the initial price of Lucasfilm:

Bottom line, if Star Wars just makes a few more films in the 2020s, it will have made back almost 75% of the asking price in the first 12 or so years of the deal. That’s in dollars adjusted back to the 2012 time period, using an 8% cost of capital. In unadjusted terms, Disney has already made their money back in most scenarios.

Bottom line, if Star Wars just makes a few more films in the 2020s, it will have made back almost 75% of the asking price in the first 12 or so years of the deal. That’s in dollars adjusted back to the 2012 time period, using an 8% cost of capital. In unadjusted terms, Disney has already made their money back in most scenarios.

Final Grades

Money from 2019 (most accurately, operating profit)

For this section, it’s pretty easy: they released a film worth a lifetime value of $800 or so million. That’s a positive from a cash flow perspective.

Long term impacts on the financial model (and the 2012 deal)

Frankly, the decision to dial back on the number of Star Wars films released will really cut back on the potential revenue Disney could make. This isn’t because they are just pulling back on some of the films, but because they’re going from potentially 8 films in the 2020s to maybe just 3. Again, in my worst case scenario, I thought they’d only drop down to 6 films.

The best way to show how the dial back in feature films impacts the future profitability of Star Wars, here’s a summary of the four financial models from a 2020 perspective.

Future Table

Under my scenarios, with only three to six potential films, the upside for discounted net profits is 2.7 billion (in the high case) to only 544 million (in the low). So if you take those numbers, and my back of the envelope percentages for each scenario…

Then the net present value of the Star Wars film franchise for the next 8 years is about $1 billion dollars.

Honestly, that number surprised me how low it is. Now, it doesn’t include a lot, from theme parks to merchandise. Or TV! But I’d admit that the decline in box office performance and qualitative ratings for the Star Wars films, and Disney’s pull back in the number of future film releases have severely taken down the value of Lucasfilm. (If you assume all my scenarios are equally likely, the NPV jumps up to $1.4 billion for the films alone.)

As for the future—thinking from 2020’s standpoint—the priority for Disney is righting the ship getting the hyperdrive working again. I’ll admit that I don’t know if Star Wars can return to making “super-hits”. Frankly, once a franchise starts trending down, only full reboots can pull it back up. I do think this two year hiatus makes sense, but the new story really has to work. Meaning Rian Johnson needs to deliver.

After that, getting back to one Star Wars film a year—while keeping the quality bar high—is the next priority. You don’t need a model to tell you that releasing more successful films is better than releasing fewer, but the model can tell us it’s worth a potential $700 million at the low end to $1.7 billion at the high end.

Brand Value

Well, it’s down. In this corner of the Star Wars business model, Rise of the Skywalker was the type of film that drew down on brand equity. Yes, it made a lot of money at the box office, but the generally lower user reviews imply that seeing the last film didn’t thrill a lot of folks.

Next Time

But don’t worry. Star Wars has a hero on his way to rescue the future of the franchise. And yes, obviously I mean Baby Yoda.