Well, it’s time to finally, officially and definitively answer the question…

Should You Release Your Film in Theaters or Straight-To-Streaming?

Rephrased, does it make sense to release films “straight-to-streaming” à la Netflix? (And formerly Apple, Prime Video, Hulu, sometimes Disney+, HBO Max in 2021 and occasionally Peacock and Paramount+?) Should they have skipped the entire theatrical and home entertainment windows?

Apparently, at least a few companies no longer think this makes sense either. Check out this headline:

That followed a previous story that Amazon will do the same thing. Frankly, I’d have loved to put this analysis out last year to predict that the streamers would come to this conclusion, but instead I’ll have to explain it.

(To be fair, I have been predicting and arguing for this for a while now. I directly answered it here and here. I built a valuation model for Netflix films here. I wrote about sending movies to theaters for The Ankler here. I mentioned it or hinted at it tons of times in my weekly Streaming Ratings Reports. Don’t worry, I have a reading list in a future article.)

But frankly, we’ve never really had enough data to answer this question. Until now. Until we got a full year (2022’s) of mostly normal data.

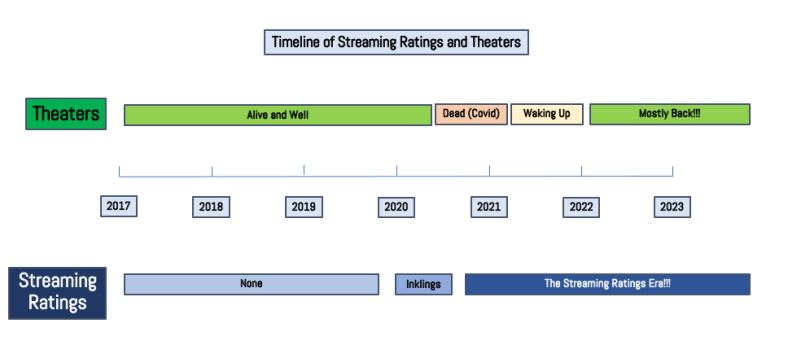

You see, before 2020, the streamers didn’t release one iota of data. And Nielsen didn’t release public metrics. And right when Nielsen started releasing a weekly top ten list of data (for folks like me to use), theaters shut down because of Covid-19!

Here’s a super crude timeline:

2022 was the first year where films came out in theaters, had a (mostly) normal theatrical run, then later came out on a streamer. We just didn’t have the data before now, so that’s partially why some of my earlier attempts to answer these questions had a lot of caveats. Or I relied on basic economics and financial models.

(Right upfront: you should know that, when I worked at a major streamer, I had PLENTY of data telling me that theatrical films crushed straight-to-streaming films in terms of performance, viewership, interest, and more. But I couldn’t very well share that data outside the company, could I?)

This month, I’m gathering all the publicly available data we have, all the theatrical box office performance, and I’m going to try to answer the question as definitively as possible. Here’s the plan:

- Today, I explain my methodology, with a teaser of the single best data looks to prove my point.

- Tomorrow, I’ll dive deep into the Nielsen data, slicing the data every (meaningful) way, whether it helps or hurts my case. And I’ll account for many objections you may have.

- Then, for the rest of the month, I’ll look at other data sources (many more!) and provide some more conclusions on what this insight means for the entertainment industry as a whole.

When we’re all done, I’ll basically have written a mini-book on this question. To keep things organized, I’m actually going to publish each successive article into one article on my Substack (behind a paywall) as well, creating one, giant resource, with a table of content to keep things organized. (But this resource will only be available to paid subscribers.) I can only do this incredibly time-consuming, data-intensive research with the support of paid subscribers. Advertising won’t support it. So again a sincere thank you to all my paid subscribers.

The Key Question: What’s the Best Way to Release a Film?

Historically, films went through a series of “windows”, something I’ve explained before, starting with theaters, then going to home entertainment, then to pay cable, then to regular broadcast TV and cable. Nowadays, streaming is concurrent with pay cable.

As I’ve shown before, the bet for obliterating all the windows into one looks like this:

It seems obvious—to me at least—that you can’t collapse all those windows and expect to make the same amount of money! You’d basically need that streaming window to generate three times the revenue what every other window used to make.

Before 2023, we didn’t have the data to judge whether this was true, and had to trust the streamers. But now we can verify it for ourselves. Do “straight-to-streaming” films have three times the viewership (or three times the value) compared to films that go to theaters?

We can simplify our question. Really it is this:

When a film comes out on streaming, does a theatrical run…

1. Help

2. Hurt

3. Have no impact on

…its streaming performance?

The streamers have always argued that “exclusivity” was valuable. Presumably that meant more people were watching on streaming because they hadn’t gone to theaters to see the movies. Or that subscribers were more likely to stay subscribed to a streamer based on the exclusivity of films that went straight to a streamer. That’s the basic bet of Netflix (and formerly Apple and Amazon, and sometimes Disney, Hulu, Paramount+, and Peacock, and formerly HBO Max).

My hypothesis, having worked with this data since 2020, is that we’ll see option 3 (no impact), with an outside chance at option 1 (theatrical generates bigger streaming numbers). And cards on the table, I’m writing this section before I’ve pulled the data for this report. (Note: Consider this me “pre-registering of the results”, even though I haven’t actually published it! But I basically pre-registered this take multiple times in the SRR last year.)

If I’m right, that’s a pretty big blow for the straight-to-streaming crowd. Remember, if all things are equal, take the extra box office money, right?

(One point on language: I categorize film release methods on streaming into three buckets:

First Run – Meaning the first day something is available

Early – Meaning any day between 2 and 60, but usually 18 days.

Pay 1 – Day 60 to the end of year one.

Today, when I say “theatrical”, I mean Early and Pay 1 films. When I say “straight-to-streaming” I mean “first run”. Also, theatrical runs can vary from blockbuster releases on 2,000+ screens to limited engagements less than 600. I usually mean over 600 screens in this analysis.)

Bottom Line, Up Front: The Answer

When I write a long, explanatory article like this, I usually save the answer for the very end of the article. But I know some of you don’t need all the dirty details, so I’ll put my results right up here.

First, here’s every film that made the Nielsen charts on streaming in 2022, divided by those that were “first run” on streaming (meaning straight-to-streaming) and those that went to theaters (in both the Pay-1 and Early windows). I saved “library” titles for a future analysis:

This is the argument for theaters.

Theatrical films tend to have HIGHER viewership in their streaming window than films that go straight-to-streaming.

Given that theatrical films also, you know, make money from box office receipts as well, in general, they make more money than films released only in one window. (Yes, yes, “but marketing costs”. I’ll cover that later.)

(Data note: For this article, I’ll be including “straight-to-streaming” films on the left in most charts, and color-coding them “grey” if we’re not talking about a specific streamer. I’ll also include domestic (meaning U.S. and Canada) box office for theatrical films with a secondary Y-axis, and color coding those dark green in all cases. For films from the same streamer, I’ll make straight-to-streaming films the lighter shade of their color.)

Maybe you don’t like averages, okay, here’s the same table but with the “median” instead, and the results are even starker:

If anything, the case against sending a film straight-to-streaming is even worse. And the theatrical films that showed up on streaming have either an average of $120 or $93 million in domestic box office to their name.

But now for some honesty, which I’ll explore more tomorrow. (Again, I’ll share as many data cuts and analyses as I can, even if they go against my argument.) There’s one big, big title in 2022 that doesn’t neatly fit into either the streaming or theatrical buckets. Here it is:

That’s right, by shifting this one title—to be fair, shifting the biggest “streaming” film in 2022 in terms of viewing in the first four weeks—things look a lot better for streaming. But should we? Glass Onion got a theatrical marketing campaign and run. But it was also pretty clearly Netflix’s big Christmas title of the year. See, data is complicated!

Either way, that’s three different data cuts all telling mostly the same picture: streaming-only films just don’t perform as well as theatrical titles. But one more look to really show the gap in awareness between theatrical titles and streaming-only:

That’s the top films on Wikipedia by page views in 2022. Of the top 25, only five are streaming, and only one barely ekes into the top 10, and that’s the franchise sequel Glass Onion.

That’s the top films on Wikipedia by page views in 2022. Of the top 25, only five are streaming, and only one barely ekes into the top 10, and that’s the franchise sequel Glass Onion.

Normally, when you write on the internet, this is where you’d stop. That’s how you go viral: keep things simple and exaggerate the conclusion. For example, in the trades, most of their data articles get a chart like the one above from a consultancy, get some quotes, and hype the conclusion.

But that’s not good enough for me (and I know not good enough for my readers, especially the paying subscribers) who want me to go deeper. Because they are smart and smart enough to push back. They could ask:

- Hey, maybe there is something different about theatrical films than streaming films. Are their budgets bigger? Are they marketed more?

- Maybe different genres tend to go theaters, and those genre films do better overall?

- Does it make sense to compare films on Disney+ and HBO Max to those on Netflix?

See, you folks are smart. And you’re right. You’re basically saying, “Is this comparison apples-to-apples?”

Well, I wouldn’t drop a conclusion this big on you if I weren’t confident in it. If I hadn’t done that analysis. If I hadn’t made those comparisons. So that’s in the data section (Part II).

But first, I’m going to explain the data, so you can know exactly the scope and scale of this data problem and how I tried to solve it.

(As I wrote above, this full article and series will be available on my Substack behind a paywall, so please subscribe. We can only keep doing this great work with your support.)