Last week was a big one for me as I tore through a lot of Mulan data to produce my soon-to-be-biggest article of all time, “1.2 million Folks Bought Mulan on Disney+”. (It looks like it will dethrone the previous champion, “Netflix is a Broadcast Channel”.)

It’s been four weeks since I checked in on the health of theaters, let’s make that the most important story of the week.

Most Important Story of the Week – We’re Heading for the (Almost) Worst Case Scenario For Theaters

I try to think about things probabilistically. As Nate Silver would recommend. The world has lots of randomness, so events and different outcomes have different probabilities.

When I made my forecast of Coronavirus’s impact on theaters for a consulting client, I had a median case of theaters reopening in August. And it almost happened, but for a summer surge in cases. The worst case was that theaters would stay closed through 2020. We’re not quite to that worst case, but we’re close.

We’re partially opened in America as 70% of theaters are allowed to be open, but the studios are pulling their tent poles until the biggest markets reopen. Given that the US still accounts for 30-50% of a film’s total box office, America’s uncertain situation is scaring off all the big studio releases.

Which is a shame, because the rest of the world is doing much better. They’ve opened and after a few weeks most customers returned. Yet the US uncertainty (combined with global piracy, which is another shame) has held all the big studios from releasing their true tentpoles. The news of the last few weeks is that studios waited to see what Tenet would do, and found it wanting.

Thus, Wonder Woman: 1984 moved to the end of the year (Christmas Day) and Black Widow moved to 2021. Though not all of Disney’s slate, as Soul is still holding onto Thanksgiving. And Universal moved up a few kids films to try their new PVOD strategy.

So I wouldn’t say we’re in the darkest timeline for theaters, but we’re closing in on it. November and December will have a lot of weight to pull to bring studios and theaters through.

Other Contender for Story of the Week – The Tik Tok Deal and Global Entertainment

Every newsletter I follow has been tracking the ins-and-outs of this story. But I waited. Would it be Microsoft? Or Oracle? Or Walmart? Or none of the above?Twists, turns and…we’ve ended up in almost the exact same place?

It’s like that quote from the Red Queen: you can run all day and end up in the exact same place. (Hat tip to the The Lost World novel for writing about that and logging it in my head from (is this right?) 25 years ago.)

All that has really changed is that Byte Dance has a new 20% owner of Tik Tok (Oracle) and it gets to keep operating in the United States. But it keeps its algorithm and presumably spy software in China.

Does this have implications from global entertainment? Assuredly, though let’s not go too far.

Clearly, China and America are headed for a new “Cold War” or “Bipolar” economic landscape. I’m not breaking news telling you that. President Trump has also escalated the situation with his proposed bans on TikTok and WeChat.

Not that this economic nationalism is unprecedented. China has banned US apps and companies for years. The biggest challenge for both EU and US companies and their nation-state champions is that there really is an unfairness in the global business situation. Netflix, Amazon, Google and others can’t operate in China due to protection laws. Yet, the EU and USA (and most OECD nations) pride themselves on allowing free and open markets. Which lets in Chinese champions.

This makes a seemingly unfair balance of power. (Though I could defend why China does it, and that reason is because US firms have definitely exploited smaller economies over the years. China has now largely avoided that fate. But this isn’t a politics website, I’m merely trying to explain why China is doing what they do.)

Where do we go from here? It’s unclear. Both presidential candidates seem concerned about China, so presumably restrictive measures could remain in place, with a Biden administration administering them a little more fairly/objectively. Long term, this could really hurt global business strategies with prominent Chinese ties.

That’s Disney, primarily, but really all the studios. One of the changes to my film model I’ve been thinking of making is to update the box office to: US, China and Rest of World. Since China is so protective, it keeps an outsized amount of profits in that country. (Only 25 cents of every box office dollar goes back to the studios. And even those can be hard to pull out.) If companies need to increasingly make “non-China included” strategic plans, that has lower global upside everywhere.

Entertainment Strategy Guy Update – The MLB-Turner Extend Their Deal with a 7% Year-Over-Year Increase

What? 7%? You saw the 65% jump in value reported in the press, didn’t you?

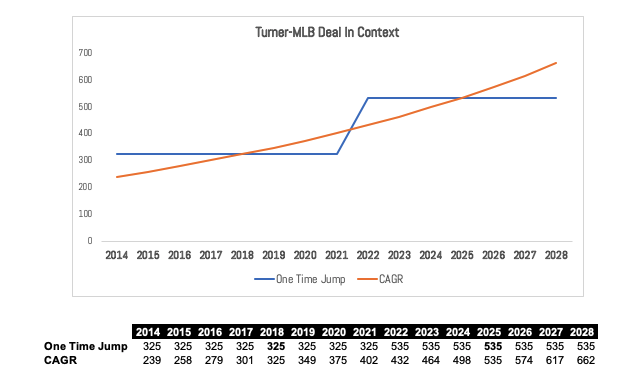

Well, the key is context and the Entertainment Strategy Guy is nothing but context. When I see big splashy deals, my first question is the time period. In this case, a seven year extension. Then I take the two numbers and plot the CAGR. I put the average deal value in the middle of the deal (since leagues like to have revenue increase on a flat rate). Then I make my chart:

As for the strategy, the next deal that shows a decrease in prices will be the first deal to show a decrease. Sports continue to be the source of programming keeping the linear channels alive, and the remaining linear players are paying a lot for them. And the bubble with 5-10% average increases in price each year has stayed on track.

Data of the Week – A Few Data Points on Subscribers (Peacock, NY Times The Daily and Shudder)

If “apples-to-apples” is the theme of the week, then I need to put the context right up front for these numbers. One of the numbers is “US only”. One is “US plus”. And two are global. Do not confuse them, since it really does change the denominator. (330 million versus 7 billion!)

First, Peacock, while explaining the increasing centralization of all NBC-Universal decisions under Peacock, Comcast let slip to the Wall Street Journal that they have gotten up to “15 million sign-ups” from the 10 million they announced in their July earnings report.

Next, Shudder, which is available in the United States, UK and some other territories, has reached the 1 million subscriber milestone.

Third, the New York Times “The Daily” podcast now reaches 4 million folks. Which is a huge number, but again don’t assume they’re all Americans.

The Athletic has also purportedly reached 1 million subscribers. While this is technically a global number, odds are it is driven much more by US customers. The caveat is that The Athletic has so aggressively discounted its business model that we don’t know what a subscriber’s actual ARPU is.

Other Contenders for Most Important Story

Disneyland (and Friends in California) Wants to Reopen

If you’ve been reading the EntStrategyGuy for any length of time, you’ll know that theme parks are a big part of Disney’s revenue stream. (Even more so than toys, which often get the credit.)

Hence, each week and month that Covid-19 keeps theme parks shuttered in California is a significant hit do Disney’s top and bottom lines. This week Disneyland, Knott’s Berry Farm and others publicly called on Governor Gavin Newsom to allow them to reopen. They noted that the reopenings in Florida and Europe haven’t seen accompanying surges in transmission, which surprised me. (Disneyland Hong Kong, however, was shut after reopening for having an outbreak.)

Notably, some theme park-adjacent businesses are opening, like the Los Angeles Zoo. So curious to see when Newsom changes on this.

DC Comics/DC Universe Staff Sees Layoffs

This is a few weeks old, but it is important enough news that I didn’t want to skip it. Warner Media is cutting staff at DC. If comic books can be the “R&D” department of a movie studio–and look at Disney, they are–then why would you cut the staff?

Of course, layoffs are complicated. Sometimes organizations really do have bloat. Sometimes they really do have redundant capabilities. But this seems like some creative executives were swept up in this part of the Warner Media reorganization. Meaning long term the cost cutting now could hurt the creative output of the future. Comic books will never be the cash cow that turns around AT&T’s fortunes, but having a strong DC could help grow HBO Max.

M&A Updates – Ion Networks is Acquired by EW Scripps

Some more merger action! This time Ion Networks is getting acquired by EW Scripps. I’ve long appreciated Ion Network’s business model. Ion Networks realized that if they owned a broadcast channel, cable and satellite providers must carry their programming. They bought up broadcast stations, and then ran cheap reruns. It’s been surprisingly successful for them:

Lots of News with No News – The Emmys!!!

I put less emphasis on The Emmy’s than anyone else. From a business perspective, I just don’t think they tell us much about what customers want or how businesses are doing. (They mostly tell you who spends the most on Emmy campaigning, as brutal as that sounds.)

The story was Schitt’s Creek, which went from nothing to something with a run on Netflix. Using the “Netflix is a Broadcast Channel” thinking, though, this makes sense. It’s like a show went from a small cable channel to running on NBC. Since it was good, naturally it had a boom in viewers.